Editor’s Note: Cosmetics & Toiletries magazine is pleased to welcome this new quarterly column, “Anatomy of a Formula,” by Eric Abrutyn to its regular lineup. This column dissects current formulas on the market to examine what ingredients are in them and why.

Deodorants have been used for more than 5,000 years, with every major civilization having left a record of efforts to mask body odors. The early Egyptians, for example, recommended application of perfumed oils such as citrus and cinnamon preparations. Over time, applications have evolved from masking offensive odors with simple perfumed oil, to today’s complex deodorant and antiperspirant (AP) applications.

APs have been around for more than 100 years. The first commercial deodorant, Mum, was patented in 1888 by an unknown inventor, and the first antiperspirant with aluminum chloride, Ever-Dry, was produced 15 years later.1 Since that time, APs have morphed in the complexity of their delivery systems and associated actives—from simple pads and squeeze bottles with astringent acidic compounds, to more sophisticated sticks and soft solids that use a buffered active.

Each AP form and active change has been initiated either by: 1) a technological breakthrough-e.g., roll-ons evolving from the invention of the ball-point pen, or polymeric hydrated aluminum oxides evolving from the molecular manipulation of simple aluminum chloride; 2) regulatory requirements such as the development of solid sticks resulting from a ban on fluorocarbon propellants; or 3) a marketing claim for the novel use of a technology or a unique delivery system; for instance, the “clinical strength” claim originating from the advent of drug labeling requirements.

Although sticks are the most popular form of APs, they are not necessarily the ideal form to deliver the highest level of efficacy. This is due to the fact that water-soluble AP actives must transport through a hydrophobic waxy matrix, slowing the process of delivery to the eccrine gland. Extrudable, opaque, creamy soft solids deliver higher levels of efficacy because their lower amounts of hydrophobic, waxy ingredients improve the availability of the active to the sweat glands. Extrudable, clear gel solids deliver lower efficacy because their silicone polyether w/o emulsifiers are believed to inhibit the availability of actives to the sweat glands.

Therefore, to best optimize the performance of AP sticks, formulators must understand their production process as well as the ingredients best suited for them.

AP Actives

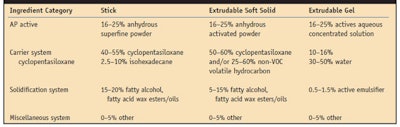

The ingredients necessary to produce a consumer-acceptable AP solid with optimized performance can be divided into four categories (see Table 1), the first of which includes AP actives. For the most part, the AP actives used are aluminum-based cationic salt chloride complexes and complexes with zirconium acid salts. These materials are referred to as “actives” on the back label of commercial AP products. There are numerous other AP actives listed in the US Food and Drug Administration (FDA) monograph,2 as well as in the US Pharmacopeia (USP).3

AP actives block sweat expulsion by forming temporary plugs within sweat ducts, thus stopping or slowing the flow of sweat to the surface of the eccrine glands.4 Plugging the sweat glands causes an osmotic pressure and prohibits transportation of sweat to the skin surface. If application of an AP active is ceased, plugs eventually are pushed from the eccrine glands, allowing normal sweat release to resume.

Selection of AP actives for solids requires careful consideration of the physical composition, chemistry and degree of polymerization to optimize efficacy and aesthetic performance.

Physical composition: Anhydrous stick and soft solid systems require a powdered active and particle sizes can vary from macro-sized (up to 75 microns) to micro-sized (below 10 microns). If the particle size is too large, consumers will detect its presence when rubbing the hard particle in the underarm area (axilla). Ideally, an active with a particle size below 45 microns ensures a non-perceptible skin feel. In formulating, however, to optimize the particle suspension, smaller particles (below 10 microns) or superfine powders aid in minimizing settling during the cooling of molten wax matrices.

Aqueous extrudable gels are based on w/o emulsion technologies. To minimize the amount of water introduced into an extrudable gel formula, the concentration of the active solution is important since it relates to the flexibility of adjusting the refractive index with glycolics for the clarity of the gel. Ideally, a high concentration active solution (45–50%) is recommended; however, during the manufacturing process, it is important to watch for destabilization of these solutions because with their high active concentrations comes the risk of gelation as the formulation ages.

Chemistry: AP actives exist in two distinct classifications-aluminum and a combination of aluminum and zirconium. Aluminum AP actives historically have been based on aluminum chlorohydrate, a salt that is considered to provide economical performance. Specifically, this active provides the required efficacy as prescribed by the FDA monograph at a lower cost than aluminum-zirconium AP actives.

Aluminum AP actives are divided into three classifications: aluminum chlorohydrate, aluminum sesquichlorohydrate, and aluminum dichlorohydrate. Aluminum chloride, also a part of this category, requires the observance of more stringent regulatory requirements and therefore is typically used in prescription-strength APs.

Aluminum-zirconium AP actives provide superior wetness-inhibiting performance (WIP)a to aluminum AP actives. The FDA monograph divides aluminum-zirconium AP actives into the following four types: aluminum-zirconium tetratchlorohydrate, aluminum-zirconium trichlorohydrate, aluminum-zirconium pentachlorohydrate and aluminum-zirconium octachlorohydrate.5 These AP actives generally are buffered with glycine-aluminum-zirconium tetrachlorohydrex GLY and aluminum-zirconium trichlorohydrex GLY being the most popular; however, there is growing interest in the others.

Degree of polymerization: Controlling the degree of AP actives polymerization (activation) results in differing atomic configurations and purity, which can enhance the WIP. Historically, high molecular weight, oxo-hydrated aluminum oxide polymers have widely been used. Proprietary-processed AP actives, typically referred to as enhanced or activated salts, are based on reducing the percentage of these high molecular weight polymers while increasing the concentration of the Al-13mer polymer, thus reducing peaks 1 and 2 as denoted in high pressure liquid chromatography/gel permeation chromatograph analytical analysis.

Carrier Systems

The second category of ingredients to produce consumer-accepted, efficacious APs includes carrier systems. AP solids must incorporate carrier systems that work synergistically with a product’s solidification system. In addition, the carrier systems should completely or at least partially evaporate so as not to leave white residue or a hydrophobic film on the skin, which can inhibit the active’s transport to the eccrine gland. Historically, carrier systems for AP solids have widely been based on volatile cyclic siloxanes because they evaporate quickly and do not leave residue on the skin. These are considered non-volatile organic compounds (non-VOCs) in the United States, which meet federal and state regulatory requirements. VOCs themselves, as opposed to non-VOCs, do not meet these regulatory requirements and may thus not be acceptable for use in AP solids. Since there is a current movement to avoid the use of some types of volatile cyclic siloxanes, alternatives include isohexadecane, a lower volatility, non-VOC; and C13-15 isoalkane, a non-VOC.

Solidification Systems

The third category of ingredients of interest to AP formulators consists of solidification systems. These systems are critical to developing solid sticks that do not melt under typical storage or consumer conditions but provide an elegant skin feel and allow for easy transfer of formula to the axilla vault.

The dynamics between solidification and volatile carrier ingredients have been investigated6,7 and reveal that the stability and aesthetics of AP sticks are critically related to the ratio of ingredient in products and the way in which the formulas are processed. Today, most solid sticks represent a combination of cyclopentasiloxane and stearyl alcohol with varying degrees of additional waxes such as hydrogenated castor wax, hydrogenated vegetable oils and polyethylene. The cyclopentasiloxane: stearyl alcohol ratio is approximately 50:18.

In the case of extrudable soft solids, higher amounts of cyclopentasiloxane and lower levels of waxes typically are used and the pour temperature is not a critical consideration; however, the pour temperature does need to be controlled to avoid the settling of suspended AP actives before a formulation is set.

Extrudable gel solids are w/o emulsions that result from a two-phase process-a continuous oil phase and a dispersed aqueous phase; the external continuous oil phase is present at greater than 70% w/w, and the internal dispersed aqueous phase represents no more than 25% w/w. The ratio of the two phases is critical to achieving optimum viscosity and spreadability. Typically the phase ratio is in the range of 80:20, external:internal.8

Additives

The fourth category of AP ingredients is comprised of miscellaneous additives. Miscellaneous additives represent a catch basin for functionally optional ingredients. Examples include: talc, corn starch, silica, fragrances, antioxidants, chelating agents, colorants, botanicals (that are usually tied to a specific claim) and odor-controlling agents.

Commercial Products

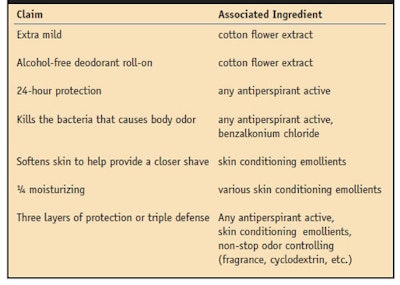

The last several years have seen relatively few changes in AP solid formulations. The changes that have occurred mainly center around exchanging the AP actives and the percentages used, along with the addition of other ingredients to allow for extended claims beyond wetness control. Some recent claims and associated technologies are shown in Table 2.

In addition, Formulas 1–7 give examples of approximate compositions of commercial AP/deodorant solid formulas and the procedures used to make them (see Formula 1, Formula 2, Formula 3, Formula 4, Formula 5, Formula 6 and Formula 7). These formulas were taken from sources of public domain and are estimates of the ingredient percentages and procedures used, to provide readers with a starting point for their own formulation work. It is suggested that readers perform a patent search to ensure they are not infringing on any existing and protected technologies.

Tackling Development Issues

Some unusual barriers exist in the formulation of APs. First, since AP solids are considered drugs in the United States and are fully or partially regulated globally, there are rigid requirements relating to the selection of actives, percentage of actives allowed, and testing, manufacturing and labeling. As an example, aluminum-only actives can be used at up to 25% concentration and aluminum-zirconium actives can be used at up to 20% concentration, based on an anhydrous basis.

Additional regulations include required testing for the percentage of wetness protection in commercial antiperspirant products via prescribed FDA protocols and statistical analyses. In addition, commercial antiperspirants must be manufactured in an FDA registered facility and operated under prescribed Good Manufacturing Procedures, and the FDA final monograph for antiperspirants strictly regulates advertising and labeling claims and communication to the consumer.

Use of an AP active not listed in the FDA monograph requires the submission of a New Drug Application (NDA), which can take 5–7 years for approval and cost up to US $10 million-and regardless, there is no guarantee that an NDA will be approved. Applications can be denied or delayed if there is insufficient safety or efficacy data, in which case, the applicant would be required to provide more data or modify the product to meet the FDA’s requirements. Additionally, even if the application is approved, the use of the new active may have missed its window of opportunity on the market.

Pilot plant scale-up and manufacturing of AP products must be conducted according to drug regulations and this scale-up to full production and stability testing can delay the launch of a product to market up to 18 months from the initiation of project.

All these barriers have affected AP innovation so that, as noted, there has been little change in AP formulating over the past 10 years; thus there is a high probability of minimal change in the foreseeable future.

Trends in APs

Although limited AP innovation currently is taking place, there is room for it in the market, especially in relation to consumer-perceivable improvements. Consumers seek brands that offer extended protection against body odor and perspiration. Therefore, the AP industry is formulating products with “long-lasting” claims, which involve the duration of the fragrance. With the emergence of niche markets, AP manufacturers have begun to target niche-market consumers globally such as organic lines in Europe; non-whitening formulas in Asia; eco-friendly lines in Latin America; and clinical strength/prescription-like, over-the-counter products. For years, the primary focus of AP products has been on minimizing wetness, with the secondary focus being on odor protection. More recently, the trend has been to focus first on odor protection and then on wetness protection. One possible reasons for this change are efforts by marketing to meet consumer demand for differentiation in the available product offerings and the successful consumer response to “deo-cologne” deodorant sprays.

Finally, with the “natural” movement, APs are going “green.” Since the AP product category is regulated in the United States and other countries as a drug, there is limited opportunity to develop natural AP actives. Therefore, the “natural” push has primarily focused on deodorancy claims with innuendos that include natural extracts in an antiperspirant, somehow making the product “natural.”

Reproduction of all or part of this article is strictly prohibited.

References

1. K Laden and C Felger, Antiperspirant and Deodorants, Vol 7 in Cosmetic Science and Technology, New York: Marcel Dekker Inc. (1988) pp 3–5

2. Antiperspirant Drug Products for Over-the-Counter Human Use, The USA Department of Health and Human Services: US Food and Drug Administration, 68 CFR Part 110, Final Rule; 2003. www.fda.gov/cder/otcmonographs/Antiperspirant/antiperspirant_FR_20030609.pdf (Accessed on March 25, 2009)

3. USP 27/NF 22 (2004); United States Pharmacopeial Convention, Rockville, MD; pg 83–91, pg 93–106

4. K Laden, Antiperspirant and Deodorants, 2nd ed, New York: Marcel Dekker Inc. (1999)

5. Eric Abrutyn, Antiperspirant and Deodorants, Harry Cosmetology, 8th Ed, Martin M. Reiger, PhD, eds, New York: Chemical Publishing Co., Inc., (2000)

6. RJ Scott and ME Turney, Volatile Silicones in Suspensoid AP Sticks, J Soc Cosmet Chem, 30(3/4), 137–156 (1979)

7. IB Chang and RA Smith, AP Sticks, Cosmet Toil, 104, 115-124 (1989)

8. ES Abrutyn, A Clear Advantage: Functional Siloxanes for Antiperspirant Application, Soap, Cosmetic and Chemical Specialties, 7 (1997)