Editor’s Note: The author of this ingredient survey discloses having previously consulted for P2 Science.

Innovation is risky. It requires investing capital in projects that may not give a return for years, and sometimes fail to launch at all. Long term, disruptive innovation has a high project failure rate because the technology is new and market demand is uncertain. Many innovative products must be launched to find a few that are big hits with substantial market impact.

For these reasons, established firms may not invest in high-risk innovation projects. Much lower risk is carried by investments in incremental improvements over existing products in a firm’s portfolio. As such, new product chemistry and functionality is more frequently the realm of startup firms. These are often founded by academic researchers and if they have a good pitch, they can gain investment and management support from venture capital firms and established corporations. In some cases, startups are even acquired by established firms, which see value in bringing the startup’s technology, patent portfolio and management team in-house.

Another barrier to innovation in the personal care industry is the global regulatory environment. Based on experience and consumer opinion, regulators worldwide have set strict rules on how new chemicals intended for application to human skin and hair, as well as for other uses, can be sold. Notably, personal care products in the U.S. are exempted from the Toxic Substances Control Act (TSCA). Products intended for surface cleansing, however, require TSCA approval. Active pharmaceutical chemicals require pre-approval from the U.S. Food and Drug Administration (FDA) via a New Drug Application. In any case, clinical safety testing is required for all applications and geographies, which is often costly.

From a different perspective, regulations have also pushed innovators to design chemistries with less irritation or sensitization potential, and that do not adversely impact the body. Take peptides and oligomers, for example. These polymers, according to the OECD definition, are mostly exempt from European REACH regulations—the most stringent regulatory framework for new chemicals. In addition, regulations have driven the development of new ways to synthesize existing chemicals, for example by using the principles of green chemistry.1 The environmental impact of both new and existing chemicals can be reduced by employing new synthesis methods, provided the methods do not introduce unwanted or hazardous byproducts.

The current paper provides a survey of personal care ingredients launched, or about to be launched, by startups. It also identifies trends in new ingredient development with a special focus on sustainable and green solutions, which respond to the market need for replacing traditional synthetic chemical processes.

Traditional Synthetic Processes

Traditionally, synthetic chemical processes used to manufacture ingredients for personal care fall into three categories.2 First, a common process is the ethoxylation of fatty alcohols, which can be obtained by hydrogenation of fatty acids synthesized by saponification of fats and oils. Fatty alcohols may also be synthesized directly using the Ziegler process.3 The feedstock in this process is ethylene and other unsaturated alkanes, derived from fossil fuels such as coal or petroleum.

The second process is the esterification of fatty acids with alcohols. This process yields common emollient oils such as isopropyl myristate and hexyl laurate. Third is the process of etherification, which is used to dehydrate alcohols to form ethers. Etherification can be applied, for example, to form hydroxypropylcellulose and related materials by ether formation with the hydroxyl groups of the cellulose feedstock.

Increasing demand for green and natural cosmetic products, coupled with the growing visibility of the UN’s Sustainable Development Goals,5 has motivated the development of sustainable products and technologies.

Other chemical processes are used widely as well. Many personal care polymers are polyacrylates and polyurethanes. Alkyl polyglycosides (APGs) are a growing category of mild surfactants formed by reacting glucose and other glycosides with fatty alcohols. Sorbitan esters are made from sorbitol by the hydrogenation of sugar, and polyglycerol ethers are made using the above-mentioned processes.

These chemical processes have contributed to the availability of a wide range of personal care products that meet the performance and sensory feel consumers want at a low product cost. However, they present drawbacks that create opportunities for new product development. Most do not use green chemistry and hence, rely on nonrenewable feedstocks. Some also release waste chemicals to the environment or generate potentially hazardous byproducts, such as 1,4-dioxane, that may become part of the product. In recent years, consumers have increasingly demanded greener and more sustainable products.4

Greener Processes and Products

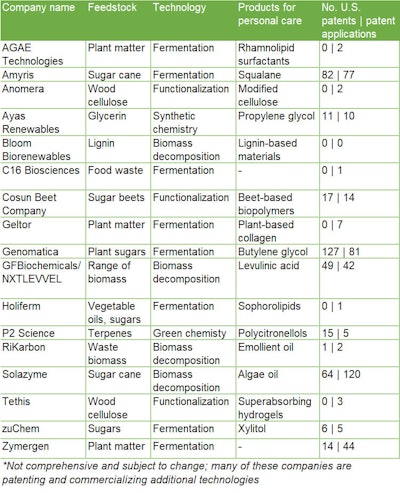

Increasing demand for green and natural cosmetic products, coupled with the growing visibility of the UN’s Sustainable Development Goals,5 has motivated the development of sustainable products and technologies. Several small firms have relevant ingredients in their development pipelines that are now entering the marketplace. Such technologies are distinguishable by the feedstocks used in place of petroleum or natural gas, most being natural and renewable. Examples range from plant-based sugars and oils, and food and industrial waste, to wood-based materials (see Figure 1).

Figure 1. Hierarchy of ingredient feedstocks and manufacturing processes

These feedstocks are most often processed using microbial fermentation. Other processes include decomposing and purifying biomass, either lignin from wood or the biomass of algae. Functionalization of natural polysaccharides is used to create functional biopolymers and emollients. Alteration of natural ingredients by chemical synthesis also is used.

Building on technologies developed in the biofuels industry, some firms focus on making basic chemicals based on renewables (see Table 1). The startup firm Ayas Renewables, for example, has developed a patented process to make renewable propylene glycol from glycerin, which is a waste stream arising from biodiesel production. Genomatica, based in San Diego, also uses biotechnology to make butylene glycol for personal care applications, reportedly even at a lower cost than with conventional manufacturing methods.6

Table 1. Recent Startups and Sustainable Technologies*

Biotech-driven Innovations

Biotech-driven InnovationsWhile the products made by the described firms are natural and renewable, it is not entirely clear how green the production process is. Fermentation is used, which is an exothermic process, but energy may be required to prepare the feedstock and agitate, cool and/or aerate the reaction mixture, in the case of aerobic fermentation. According to Genomatica, its fermentation process for the production of butylene glycol has substantially lower emissions than the conventional process.7 Still, opportunities for innovation remain by lowering emissions further and making the process greener.

As stated previously, the dominant processing method used by startups is fermentation, which can produce a wide range of ingredients based on renewable and natural feedstocks. These ingredients generally contain fewer contaminants and byproducts than plant extracts.8

Clearly, fermentation is not confined to startup firms. A number of global chemical makers has invested in fermentation plants to commercialize new personal care ingredients. One leader in this area is Evonik, which has produced glycolipid biosurfactants, specifically sophorolipids, for personal care. Stepan has entered this field as well, with its acquisition of NatSurfAct, a maker of rhamnolipid biosurfactants via the fermentation of vegetable oil. BASF has been active in this field since 2015, when it launched an algal betaine surfactant derived from microalgae oil, in a collaboration with Solazyme. Finally, Inolex markets a cationic emulsifier produced by the fermentation of plant materials.

A higher value-added ingredient made by biotech is the plant-based collagen offered by Geltor. One advantage of the production of bioactive ingredients using biotech methods is that they are stereospecific. For example, ceramides made in this way are similar to those in human skin, whereas those produced by synthetic chemistry are racemic mixtures and less suitable for skin applications.8

Natural, Upcycled and Sustainable

Sometimes nature offers new chemistries with cosmetic efficacy, and so long as their purity is maintained, the demand for these quality ingredients can benefit the local communities from which they are sourced. Argan oil, for example, has been in high demand for cosmetic applications due to its antioxidant properties. Its sourcing has benefited the communities that cultivate the argan tree in Morocco. Resources must be sustainably managed, however, as this high demand has led to increasing scarcity for the argan fruit. Its ecological benefits for the argan forest and socioeconomic benefits to local communities, though, are not contested.9

Similar benefits are offered by illipe butter, which is made from the nuts of a tree grown in the rainforests of Borneo, in a factory operated by Forestwise. The harvest of this material and similar rainforest products benefits local communities by making the rainforest a source of income; again, so long as resources are maintained.10

In many applications, petrochemical materials perform better than plant-based materials.15 And unless there is a clear benefit to using a new ingredient, it does not make business sense to substitute a high performance petrochemical ingredient with a newly developed version of virtually the same thing.

Other hitherto unused natural ingredients can substitute for synthetic chemicals in personal care products. Anomera is a Montreal-based company that makes carboxylated cellulose nanocrystals based on wood cellulose. These can be applied as microbeads in cosmetics, substituting for plastic microbeads that are not biodegradable.

Lignin is a wood product that can be converted into useful ingredients for personal care. In fact, this material is the focus of several startups because lignin waste, obtained as a byproduct from paper production, is abundant. However, lignin is a difficult molecule to break down because it consists of crosslinked phenolic polymers. One Swiss firm that has been successful in converting lignin waste is Bloom Biorenewables, which uses a separation method to isolate the lignin fraction from the cellulose fraction in waste wood. The lignin can then be depolymerized to yield small aromatic molecules for fragrance applications. The cellulose part can be functionalized for application in cosmetic products. These processes avoid the traditional burning of the waste wood as fuel, and therefore lead to much lower greenhouse gas emissions.

Tree sap is another forest product that can be collected and converted into useful materials. Connecticut-based P2 Science has commercialized cosmetic oils and waxes based on terpenes, which are obtained from the distillation of pine tree resin. A wide range of ingredients can be manufactured with this feedstock using green chemistry principles. These and similar ingredients are fully sustainable—a key property demanded by the global cosmetics market.

Biosimilar Alternatives to Naturals

As mentioned, one risk in coverting cosmetic ingredients to biobased materials is that the ecosystems growing the natural feedstocks can come under serious stress due to overexploitation. The large-scale production of palm oil in Southeast Asia, for example, has led to deforestation, a loss of biodiversity and poor labor conditions in the local population.

With the Roundtable on Sustainable Palm Oil (RSPO), the cosmetics industry has created a mechanism to certify sustainable palm oil as RSPO, making it more attractive to cosmetic brands. This could be a model for other natural resources as well, since similar sustainability issues exist in coconut oil and other natural materials. Unfortunately, even with the widely recognized RSPO certification, non-certified palm oil continues to find a market.11

To stop the further degradation of ecosystems that produce cosmetic ingredients, biosimilar materials can be produced by the fermentation of waste streams such as from foods. New York firm C16 Biosciences has developed a process for producing oils that are almost indistinguishable from palm oils in their chemical and physical properties, but that are based on fermented food waste.12 This idea brings the natural ingredient movement almost full circle back to synthetic and nature-identical ingredients, but made using green chemistry and non-fossil fuel feedstocks. If this process can become cost competitive with natural palm oil, it may be possible to avert further environmental damage from harvesting natural oils and sugars. However, nature-identical materials may not meet the consumer demand for fully natural products.

Commercialization Pathway

The range of new personal care ingredient technologies developed by startup companies is broad. However, relatively few of these ingredients are applied in large scale applications due to significant barriers to their wider market adoption.

Chief among these barriers is cost. The cost of biosurfactants such as rhamnolipids and sophorolipids that have been on the market for a few years can be multiple the price of established commodity surfactants.13 These prices have come down, however, and the cost pressure may be less in other, less commoditized areas of the ingredient industry.

Also, if the feedstock for new products is sourced from currently discarded waste, the product will be more competitive, in addition to offering sustainability benefits.14 Examples of abundant waste streams are food, lignin and agricultural waste such as orange peels.

Another major barrier is product performance. In many applications, petrochemical materials perform better than plant-based materials.15 And unless there is a clear benefit to using a new ingredient, it does not make business sense to substitute a high performance petrochemical ingredient with a newly developed version of virtually the same thing. New ingredients must offer benefits that are visible to the consumer in order to outweigh their higher price and costs to make the switch.

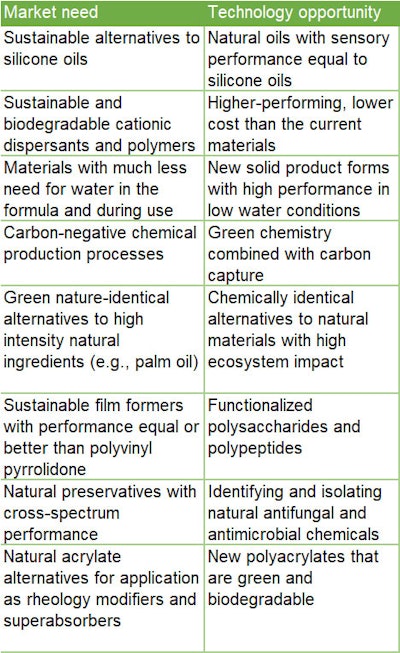

New materials that are currently commercially available, or close to commercialization, are biosurfactants and natural oils and emollients. There is a receptive market for cosmetic oils and esters that have sustainability benefits. However, the market niche is still small, and their petrochemical equivalents still dominate the industry. A previous article4 outlined a few ingredients that are difficult to replace by sustainable materials, notably acrylate polymers and silicones. The technologies in development at emerging companies mostly do not address these markets, which leaves a big opportunity on the table (see Table 2).

Table 2. Opportunities for New Personal Care Ingredient Technologies

Conclusion

ConclusionMany startup firms have introduced or are close to launching new chemical ingredients for personal care. They are driven by a strong market for green materials, as well as advances in green chemistry and fermentation technology. However, big opportunities for new technology development remain in the personal care ingredients marketplace.