Ingredion conducted a global proprietary consumer research study with a focus on sun care (sunscreen). Participants demonstrated a preference for cleaner, simpler, lighter-feeling sun care products, a trend that is reshaping the sunscreen aisle. Study methodology is cited in part 1 of the clean beauty series, however of the skin care respondents, sun care respondents equaled 990.

Clean beauty positioning

What do these consumers tell us they associate with “clean” sunscreen?

“Natural” claims are important, but equally important is the expectation for better performance over traditional sun care products. “Clean” beauty positioning in sun care products closely aligns with “green” claims, which can include plant-based and environmentally-friendly. In addition, when consumers see claims such as “organic,” and “free-from,” they also expect a product that performs.

Of those surveyed, 30% regularly use sun care products, however there is variability in use by country. While more than 50% of respondents in Columbia and South Korea reported using sunscreen, only 20% of respondents in the U.S and 11% in France reported sunscreen use. However, the market is driven by the U.S. as it holds the biggest market volume, according to Euromonitor.

Growth in purchase and usage behaviors

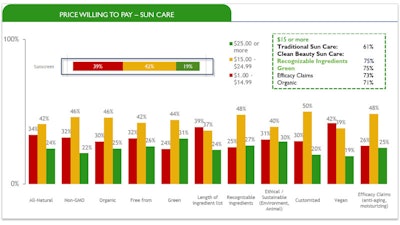

Growth in purchase and usage behaviorsOf the consumers surveyed, 61% are willing to pay $15.00 or more for current sun care products. And with “clean” beauty claims, more consumers are willing to pay $15 or more, particularly “recognizable ingredients” (75%), “green claims” (75%) and “efficacy claims” (75%). Consumers from all demographic subsegments said they seek sunscreens that both perform and do not harm the environment or cause sensitivity to the skin.

Reactions to ingredients and labels

According to the survey, ingredients and price are the most important considerations when purchasing sun care products. Consumers said they seek reviews and recommendations because of possible sensitivity to ingredients. Seeing parabens, synthetic fragrances, sulfates and silicones in sun care products are unexpected when accompanied with claims such as “green,” “vegan,” and “organic.”

Additionally, 28% of consumers considered plant-based proteins and 20% found vegetable juice as acceptable ingredients when joined with “green” claim positionings. The study found no difference between gender or age in the likelihood to read ingredient labels on sun care products.

Impact of “clean” beauty

Our survey showed that 75% of consumers are very likely to purchase sun care products in the next six months with the claims “green” and non-GMO. Consumers also said they seek gentle and “natural” solutions that protect their skin and exceed the performance of traditional products.

According to Euromonitor, the sun care market is projected to grow globally by 3% in the next five years to $11.8 billion. The largest growth in sales according to Euromonitor has been in Thailand, Indonesia, Laos, Myanmar and India. The largest increase in claims on new product launches include efficacy claims, UV protection, and reduction of redness, as well as ethical environment (94%), petroleum-free (82%) and “natural” (58%).

For more about CLEANgredient™ solutions, visit Ingredion at www.ingredion.us/beauty

Article written by:

Angelika Rol, Ingredion Incorporated, Product Development Marketing, Global Beauty and Home Care

Oyelayo Jegede, Ingredion Incorporated, Senior Manager, Global Sensory

Disclaimer:

The above paid-for content was produced by and posted on behalf of the Sponsor. Content provided is generated solely by the Sponsor or its affiliates, and it is the Sponsor’s responsibility for the accuracy, completeness and validity of all information included. Cosmetics & Toiletries takes steps to ensure that you will not confuse sponsored content with content produced by Cosmetics & Toiletries and governed by its editorial policy.