Abstract: The present article reviews several emerging bio-based ingredient innovations, including their chemistries, limitations and applications. It especially focuses on novel biosurfactants and bio-based emollients and oils.

Startup chemical firms developing bio-based cosmetic ingredients have secured major investments to scale production to commercial levels. These ingredients, typically biosurfactants or bio-based oils and emollients, are derived through the fermentation or chemical modification of bio-based materials.

In the next few years, market analysts1 project the bio-based materials market will rise at a significant 22.1% CAGR (2025 – 2029), making now an opportune time for R&D teams to evaluate new bio-based alternatives; not just for green credentials, but for the unique functional benefits they may offer in next-generation product design.

The present article reviews several of these emerging innovations, including their chemistries, applications and limitations. It especially focuses on novel biosurfactants and bio-based emollients and oils.

Innovation in Startups and Ingredient Targets

A good amount of cosmetic ingredient innovation happens in startup companies. It often centers on chemicals produced by biotechnology and on polymers and oligomers – which are not subject to the European REACH regulations.2

Sustainability and biodegradability are important market drivers for new ingredients. Materials made by fermentation can find a ready market because they are generally biodegradable and have a low carbon impact. They also do not contain common synthetic impurities such as 1,4-dioxane, which can be present in ethoxylated ingredients.

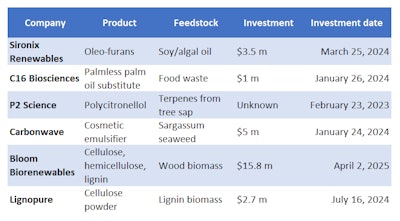

Recently, various startups received major investments to allow them to grow their production capabilities to commercial scale.3 Others have developed renewable ingredients to lab scale and are preparing to up their production to pilot scale; or have partnered with larger specialty chemical firms to help with manufacturing and distribution.

In general, most startup firms target one of three product types. The first is biosurfactants, specifically glycolipids. Second, a few firms develop oils and emollients based on renewable feedstocks. The third type includes oleofuran surfactants, emulsifiers and amino acids and proteins.

One major challenge for these new ingredients is that they are often more costly than traditional petroleum-based ingredients.4 For this reason, some companies have focused on the beauty and cosmetics industry rather than cleansing because the profit margins for ingredients are higher and the volumes are lower. However, the aspirational goal of many firms is to replace legacy petroleum-based surfactants in cleansers and detergents with bio-based versions that are milder and more sustainable.

New Ingredient Chemistries

Bio-based cosmetic ingredients coming to market generally fall into three categories based on the feedstocks used and production processes. The first is plant extracts that act on biological pathways in the skin. Such bioactives are launched each year and make skin appearance-related claims based on clinical and consumer tests. Bioactives are out of scope for this article but a future paper is planned to review them.

In addition, bio-based ingredients are often produced by fermentation using yeasts or bacteria. In these cases, the fermentation process is carefully controlled with known feedstocks and extensive post-manufacturing purification. Common feedstocks are bio-based sugars, such as corn sugar, plant oils and other biomass.

Many waste products from agriculture and the foods industry can be used as feedstocks in fermentation. Some firms use post-consumer food waste as well, which is challenging due to possible contamination with foreign objects and substances. Pretreatment of the feedstock prepares it for the fermentation process.

The main category of bio-based ingredients produced by fermentation is biosurfactants, which find use in cleansers and foams. The most prominent fermentation-produced biosurfactants are glycolipids, encompassing mainly sophorolipids and rhamnolipids.

The third category of bio-based ingredients are those made by traditional chemical processing of bio-derived components. This includes the more established alkyl polyglucoside biosurfactants (APGs) and also biosurfactants made by coupling sugars with bio-based oils.

Biosurfactants

Glycolipids: Glycolipids are surface active compounds consisting of a glycolic head group and an aliphatic tail. They differ from APGs in that they are generally produced by fermentation processes, whereas APGs are made by reacting glucose with fatty alcohols or acids, both from renewable sources, in a chemical synthesis process.

Two main varieties of glycolipids exist. Rhamnolipids are anionic glycolipids consisting of mono or di-rhamnose sugars linked to β-hydroxylated fatty acids with various chain lengths. They are produced by microbes, mainly Pseudomonas aeruginosa. The number of rhamnose units and fatty acid chain lengths can vary, so that rhamnolipids are complex mixtures. As fatty acids, they are anionic surfactants.5 Rhamnolipids are good foaming agents compared to other glycolipids.

The other main group of glycolipids are the sophorolipids. These are composed of a sophorose sugar head and a fatty acid tail. Sophorose is a dimer of glucose and a stereoisomer of maltose, another glucose dimer. The fatty acid is terminally linked to the sophorose so that it has a carboxylic acid group at the other end of the carbon chain. This carboxylic group can be free, forming the acidic form of the sophorolipid, or esterified with one of the sophorose hydroxyl groups, the lactonic form.

The relative levels of the lactonic and acidic sophorolipid determine the properties of the sophorolipids, as does the hydrocarbon chain length distribution. Sophorolipids are produced by yeasts such as Candida bombicola and Starmerella bombicola.4, 6 They are less surface active and milder than rhamnolipids.

Less widely used glycolipids are based on other polyol sugars, such as arabinose and mannose.

Glycolipids are bio-based, biodegradable and have low toxicity, making them attractive for applications in bioremediation, enhanced oil recovery, food and personal care, and medicine, among others. While generally, they have been more costly than commodity surfactants,7 the gap may become smaller as glycolipid manufacturers scale up. Several glycolipid makers have recently received investments that will be used to increase production scale (see Table 1).

Sophorolipids by fermentation: A number of startups make sophorolipids by fermentation.8 With a current capacity of more 1,000 ton/year, UK-based Holiferm has received funding to build a 3,000 ton/year sophorolipid fermentation reactor with a 15,000 ton/year version planned for following years. The company uses a patented gravity separation technology to purify the product, which reportedly lowers the carbon footprint of the process and reduces costs. According to Lawrence Clarke, technical sales manager at Holiferm, the gravity separation also yields sophorolipids with a high percentage in the lactonic form, which gives the best degreasing performance in applications.

For biosurfactants, a low price point is required for market success, and Holiferm found that in some applications, a smaller amount of its sophorolipids can be used than with other bio-based surfactants. Another reported advantage of the company’s approach is that the feedstock consists of non-GMO rapeseed oil that is sourced in the EU, in contrast to other bio-based surfactants that use tropical oils (such as palm and coconut oil), which are less sustainable. Notably, Holiferm has partnered with Sasol, a global chemical company based in South Africa.

Solon, Ohio-based Locus Fermentation Solutions has partnered with Dow and received funding to support a 2,500 tons/year capacity to make sophorolipids for home and personal care.9 The company achieved U.S. Environmental Protection Agency (EPA) Toxic Substances Control Act (TSCA) registration for its biosurfactants.

Another U.S.-based supplier is Glycosurf, which has been funded by grants from the U.S. Department of Energy. Glycosurf offers a variety of glycolipids but has not yet scaled up. Also, glycolipid maker BioReNuVa, based in Austin, Texas, received an undisclosed amount from Hallstar in exchange for a minority stake.10

Belgian startup Amphistar produces sophorolipids using the Starmerella bombicola yeast and a feed consisting of upcycled organic waste streams. It recently raised US $13.5 million to scale up its fermentation process at a plant in Antwerp. Co-founder Sophie Roelants shared there is clear market interest for sophorolipids but the commercial launch has been delayed due to the required REACH registration.

The upcycled feedstocks Amphistar relies on are available in high volumes, so they reportedly have a consistent high quality and purity compared to other suppliers. Besides, yeast-based processes are robust and resist contamination. A lifecycle assessment provided by Amphistar shows that its upcycled sophorolipids have a significantly lower environmental impact than other sophorolipids. The company’s objective is to reach cost parity with commodity products in 10 years, when the bio-based economy will be more mature.

Rhamnolipids: Glycolipids are also offered by Evonik. In fact, an industrial scale plant in Slovenská Ľupča, Slovakia, began producing its first rhamnolipid surfactants for household and personal care cleansing in 2024.9, 11 These rhamnolipids are produced by a fermentation process using the bacteria Pseudomonas putida and a corn sugar feedstock. Like all glycolipids, rhamnolipids are biodegradable and good foam formers, making them well-suited for rinse-off applications in home and personal care.

Other glycolipids: Biosurfactants can also be based on other sugars. San Carlos, CA-based Ruby Bio developed a fermentation technology that uses wild-type yeast strains (such as Rhodotorula and related yeast species) to make glycolipids based on corn sugars and upcycled waste.12 According to CEO Charlie Silver, these biosurfactants offer cleansing performance similar to sodium lauryl sulfate at a lower cost than other glycolipids. The firm can produce biosurfactants at the 1,000 tons/year scale.

Other biosurfactants: Seattle-based Sironix Renewables follows a different route to biosurfactants that does not use fermentation. It combines sugar-derived furans with natural oils, preferably soy or algal oil, to make a renewable oleo-furan surfactant. Sironix CEO and Co-founder Christoph Krumm says the oleo-furan functions well in hard water without the need for chelating agents.15 In March 2025, Sironix received a $3.5 million venture capital investment to scale up its manufacturing operations.

Bio-based Emollients and Oils

Biosurfactant producers have received the most funding recently, but other startups work on functional ingredients for home and personal care as well (see Table 2). The majority of emollients and emulsifiers in cosmetic formulations is bio-based. These ingredients are often derived from palm oil, coconut oil or other oils extracted from plants.

Using extracted plant oils as a source of care ingredients instead of other biomass presents two disadvantages. In the case of palm and coconut oils, some large oil palm plantations in tropical regions have caused a loss of habitat for native species and a loss of biodiversity. In addition, for these oils, transportation from the regions of origin to the product manufacturer can add significantly to the carbon footprint of the material. In the case of soybean oil and rapeseed oil (canola oil), the farmland acreage used for oil production is usually not available to grow food crops, potentially leading to higher food prices or shortages.

Reducing the need for palm oil from palm plantations, startup firm C16 Biosciences has developed a fermentation process that uses yeast cells fed by sugars from food waste. Torula oil, its palm oil substitute, reportedly has a much lower environmental impact. Earlier this year, C16 raised $4.5 million to develop ingredients for the food industry. The fermentation-grown alternative palm oil is said to have a more consistent quality than plantation-derived palm oil and generate lower CO2 emissions. As with all bio-based ingredients, a hurdle is reaching price parity with commodity palm oil.13

P2 Science developed a green chemistry process to produce polycitronellol from terpenes derived from tree sap, a waste product in the paper industry. Since receiving additional funding in 2024, it launched additional polycitronellol emollients complementing its original launch of the terpene-based polycitronellol. The company reports it has shown that its ingredients outperform other emollients in hair care and fragrance applications.14

Another upcycled biomaterial is sargassum seaweed, the largest existing seaweed bloom. Startup firm Carbonwave collects the sargassum from beaches and processes it into fertilizer and a cosmetic emulsifier. It received $5 million in venture capital investment in 2024.

Finally, companies with technologies to turn wood biomass into lignin and cellulose have been funded, with Bloom Biorenewables receiving $15.8 million and Lignopure $2.7 million. Lignin is highly crosslinked and difficult to process. Lignopure turns wood into cosmetic grade cellulose powder, while Bloom created a technology to separate cellulose from lignin polymers and cellulose sugars. This technology will be scaled up to supply industrial quantities of microcrystalline cellulose for cosmetic applications.

Formulating with New Ingredients

Including new ingredients in product formulations offers opportunities for improved performance, higher sustainability and potentially unusual and unexpected benefits. For example, Sironix reports its bio-based surfactant can act as a chelator in addition to its surface active properties, and P2 Science claims that polycitronellol performs well as a fragrance fixative.

Ingredient suppliers often provide example formulations with their ingredients to educate formulators and illustrate the properties of their materials. Startups offering ingredients with novel chemistries would benefit from doing the same. This may require startups to recruit a finished product formulator with experience in developing formulations for the target product segment.

It is difficult to develop formulations that truly highlight the new ingredients and their properties in applications. Sophorolipid maker Holiferm lists more than 30 example formulas on its website, for applications ranging across home and personal care. The level of glycolipids recommended is 1% to 10% depending on the application. However, most formulations have the glycolipid as a cosurfactant in addition to primary surfactants, such as cocamidopropyl betaine and sodium laureth sulfate.

Locus Fermentation Solutions markets its sophorolipids with Dowa. Its example formulations have the sophorolipid as a secondary surfactant with a glucoside or glycoside surfactant in facial cleanser applications.

The same is true for formulations with Evonik’s rhamnolipid biosurfactants or Amphistar’s sophorolipids. Test data provided by Evonik describes the rhamnolipid in formulas as a cosurfactant with other surfactants. According to Karima Benaissi of Amphistar, the sophorolipid is best as a cosurfactant in cleansing applications, but it can be used as the sole surfactant and emulsifier in leave-on products. In that case, the biosurfactant can provide the maximum sustainability benefit.

Conclusions

Leading personal and home care startup firms have received funding that will allow them to transition from pilot scale projects to commercial scale production. Many of these companies have developed fermentation-based biosurfactants and oils. These materials offer formulators new tools to reduce environmental impact while maintaining product performance. However, cost and regulatory hurdles still limit adoption.

Even so, the outlook is promising. As scale increases and formulation expertise develops, these novel ingredients are expected to achieve broader use in home and personal care products. For R&D teams, now is the time to evaluate bio-based alternatives — not just for their green credentials, but for the unique functional benefits they may offer in next-generation product design.

Footnotes

a EcoSense (INCIs: Vary) is a brand of Dow.

References

1. The Business Research Company. (2025, Jan). Bio-based materials global market report 2025 – By type (bio-based polyurethane, bio-based paraxylene, bio-based polypropylene, bio-based polyamides, other types), by application (rigid packaging, flexible packaging, electrics and electronics, consumer goods, automotive and transport, other applications), by end use (food and beverage, pharmaceuticals, automotive, textiles, agriculture, other end users) – Market size, trends and global forecast 2025-2034. Available at https://www.thebusinessresearchcompany.com/report/bio-based-materials-global-market-report

2. de Mul, M.N.G. (2021, Apr 19). Startup solutions: A survey of green and sustainable innovations. Cosm & Toil. Available at https://www.cosmeticsandtoiletries.com/cosmetic-ingredients/natural-sustainable/article/21836077

3. Bettenhausen, C. (2025, Mar 17). Two biosurfactant makers scale up. Chem & Eng News. Available at https://cen.acs.org/business/specialty-chemicals/Two-biosurfactant-makers-scale/103/web/2025/03

4. Pal, P., Chatterjee, N., Das, A. and McClements, D.J. (2023). Sophorolipids: A comprehensive review on properties and applications. Adv Colloid Interface Sci, 313, 102856.

5. Aslam, R., Aslam, J. and Hussain, C.M. (2023, Nov 17). Industrial applications of biosurfactants and microorganisms. Elsevier. Available (for purchase) at https://shop.elsevier.com/books/industrial-applications-of-biosurfactants-and-microorganisms/aslam/978-0-443-13288-9

6. Miao, Y., To, M.H., ... Lin, C.S.K., et al. (2024, Jan 19). Sustainable biosurfactant production from secondary feedstock — Recent advances, process optimization and perspectives. Front Chem, 12 1327113.

7. Bettenhausen, C. (2024, May 15). Biosurfactant investment grows. Chem Eng News. Available at https://cen.acs.org/business/biobased-chemicals/Biosurfactant-investment-grows/102/i15

8. Wongsirichot, P. and Winterburn, J. (2025). Recent advances in sophorolipid production: From laboratory to pilot scale and beyond. J. Cleaner Production, 492, 144898.

9. Bettenhausen, C. (2024, Jan 25). Biosurfactants scale up. Chem Eng News. Available at https://cen.acs.org/environment/green-chemistry/Biosurfactants-scale/102/i3.

10. Personal Care. (2025, Mar 20). Hallstar invests in Texas biotech outfit BioReNuva. Step Communications. Available at https://www.personalcaremagazine.com/story/47698/hallstar-invests-in-texas-biotech-outfit-biorenuva

11. Esposito, C. (2024, Jan 25). Evonik’s industrial scale rhamnolipid biosurfactant plant produces first product. Happi. Available at https://www.happi.com/breaking-news/evoniks-industrial-scale-rhamnolipid-biosurfactant-plant-produces-first-product/

12. Kambam, P. and Maxwell, C. (2025). Engineered polyol lipid producing microorganisms. World Patent WO 2025/096839 A1. Available at https://tinyurl.com/3khpc4za

13. Pratty, F. (2023, Oct 19). 'Precision fermentation’ startups pursue palm oil alternatives. Financial Times. Available at https://www.ft.com/content/cfe2070f-c8f2-4145-9944-b72d6c7fa8ae

14. Oblon, A., Wood, D., Foley, P. and de Mul, M.N.G. Sustainable, multifunctional polycitronellol polymers add shine to hair. Happi. Available at https://tinyurl.com/5y5r7kbs

15. Peplow, M. (2019). C&EN talks with Christoph Krumm, surfactant innovator. Chem Eng News, 97(25) 28-29.